Biosimilars vs. biologics

The first competitor for Humira® (adalimumab) has arrived in the U.S market. Humira is a biologic drug used safely and effectively by more than a million patients living with serious inflammatory diseases.1 Amjevita™ (adalimumab-atto), is a biosimilar drug manufactured by Amgen.2

Still more new biosimilar products are waiting to compete not just with Humira, but with dozens of other biologic drugs over the next few years.

Biologic drugs are complex molecules manufactured inside living systems.3 Biosimilars are biologic drugs that are highly similar to and have no clinically meaningful differences in terms of safety, purity and potency from an existing U.S. Food and Drug Administration (FDA)-approved biologic.4

While they differ structurally, both generics and biosimilars enter the market after the original brand is no longer protected from competition. Biosimilars, like generic drugs, may reduce the price of therapies compared to the original branded medicines.

In this article, we will review the cost savings we expect from the coming surge of biosimilar drugs. In addition, we will also examine the question of how, or whether, the new drugs may be substituted for the existing biologics.

Impact of biosimilar sales prices

Biosimilars aren’t completely new. They first became available in the U.S. in 2015, and have already made an impact in costs.5

One study has found that average biosimilar sales prices are more than 50% lower than the original branded ("reference") product. And the prices for the branded biologics themselves also decline once biosimilars enter their space. Prices for brand-name biologics fall 25% on average once biosimilars arrive.6

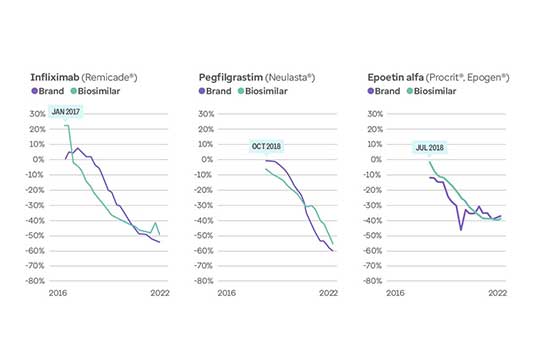

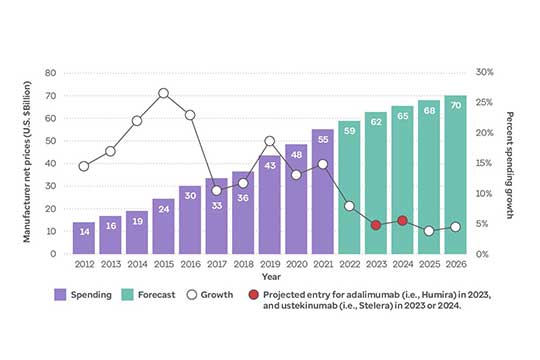

Price impact of biosimilars

Popular brand-name biologics drop up to 60% with biosimilars

Each line shows that prices decline for both biosimilars and their branded reference products from time of launch.

Prices for biologic drugs Remicade, Neulasta, and Procrit/Epogen as well as for their respective biosimilars decreased by 52%, 60% and 42%, respectively, once the biosimilars were introduced.

Humira biosimilars

Amjevita is actually just one of as many as 10 Humira biosimilars expected to launch this year or next. As even more biosimilars enter the market beginning in July 2023, we can expect this competition to increase price improvement across the class.7

AbbVie is projecting that this new competition will lead to 37% lower sales for 2023, as purchasers switch to other options.8 But the full savings effect will take longer. Industry experts predict that an increasingly competitive pricing environment will emerge over the next 18 months or so.9

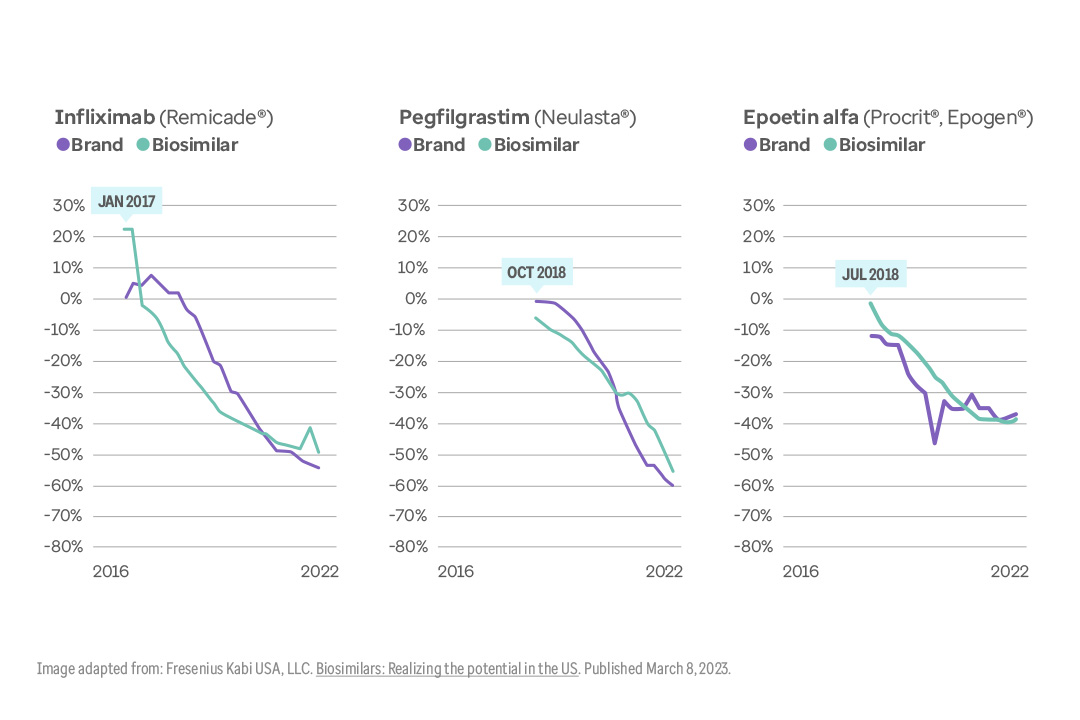

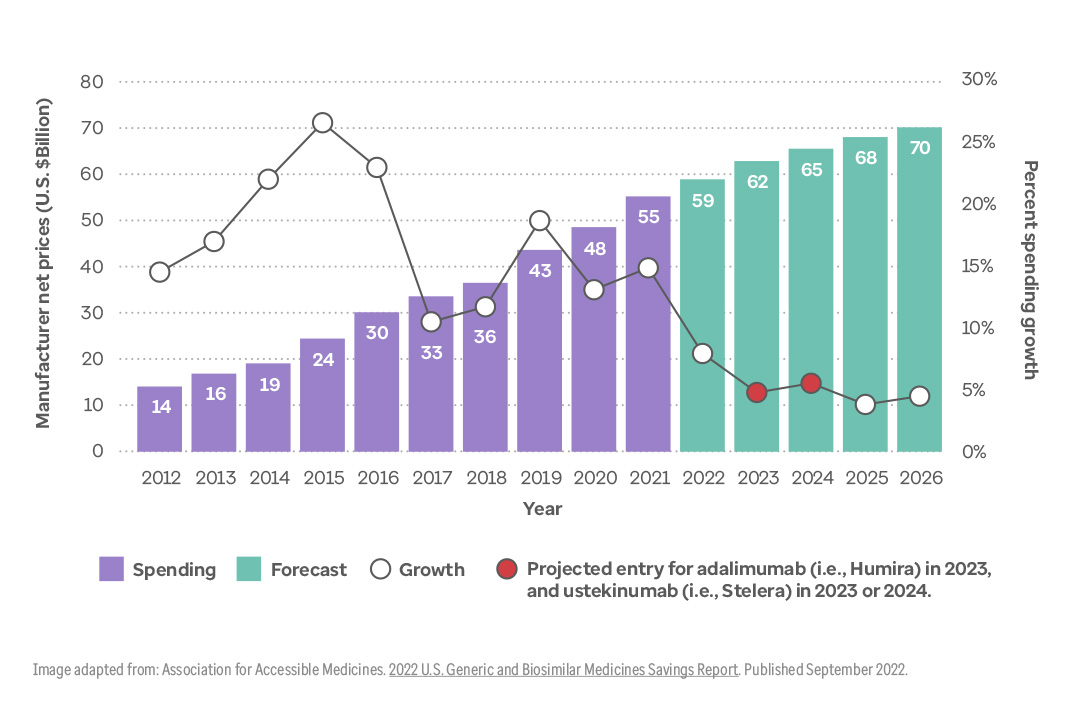

This graph shows how biosimilar competition will help moderate growth in the autoimmune class through 2026.

Big turnaround in Humira class of drugs

Spending, price growth for autoimmune drugs: 2012 through 2026

Prices and spending growth are expected to drop for high-cost autoimmune class due to biosimilars.

Graph showing spending and price growth in the autoimmune drug class from 2012, and projected through 2026. Spending growth peaked in 2015 at 25%, and is expected to decline to 5% by 2026. Spending increased by more than 290% from 2012 through 2021, but is expected to rise only 19% from 2022 through 2026.

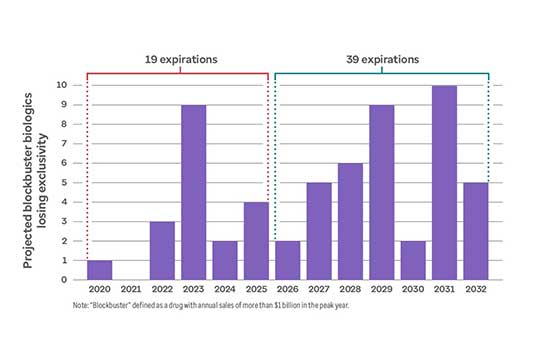

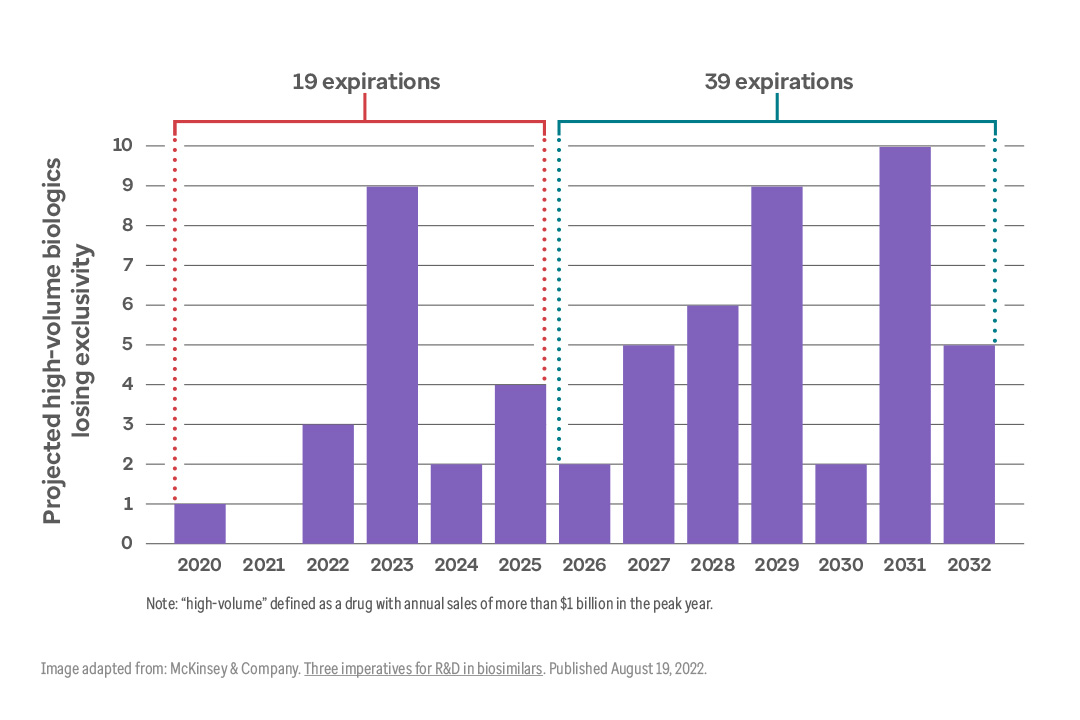

Not just Humira

Humira isn’t the only biologic facing biosimilar competition. Dozens of high-cost biologic drugs will face new competition over the next decade.

For example, McKinsey & Co. estimates that by 2025, 19 high volume biologics (i.e., drugs with sales >$1 billion) will lose exclusivity. Then, between 2026 and 2032, 39 more high-volume biologics should also lose patent protection. Collectively, they represent more than $270 billion in expected peak sales across the U.S. and the European Union (EU).10

As this graph shows, approximately 55 high-volume biologic drugs could lose exclusivity in the U.S. by 2032.

55 high-cost biologic drugs face competition

Patent expirations signal newly competitive biologic drug market

Humira is just one of the top-selling biologics with biosimilar competition on the way.

Graph shows 19 drugs selling more than $1 billion per year to lose market exclusivity from 2020 through 2025. An additional 39 such drugs will lose exclusivity from 2026 through 2032.

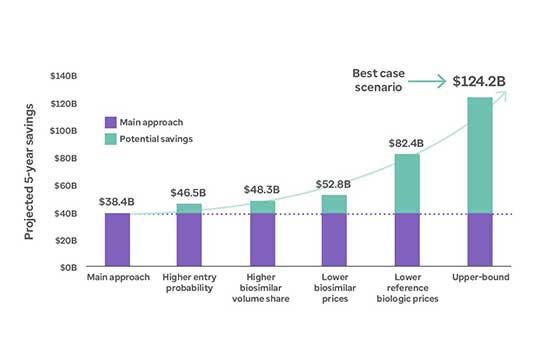

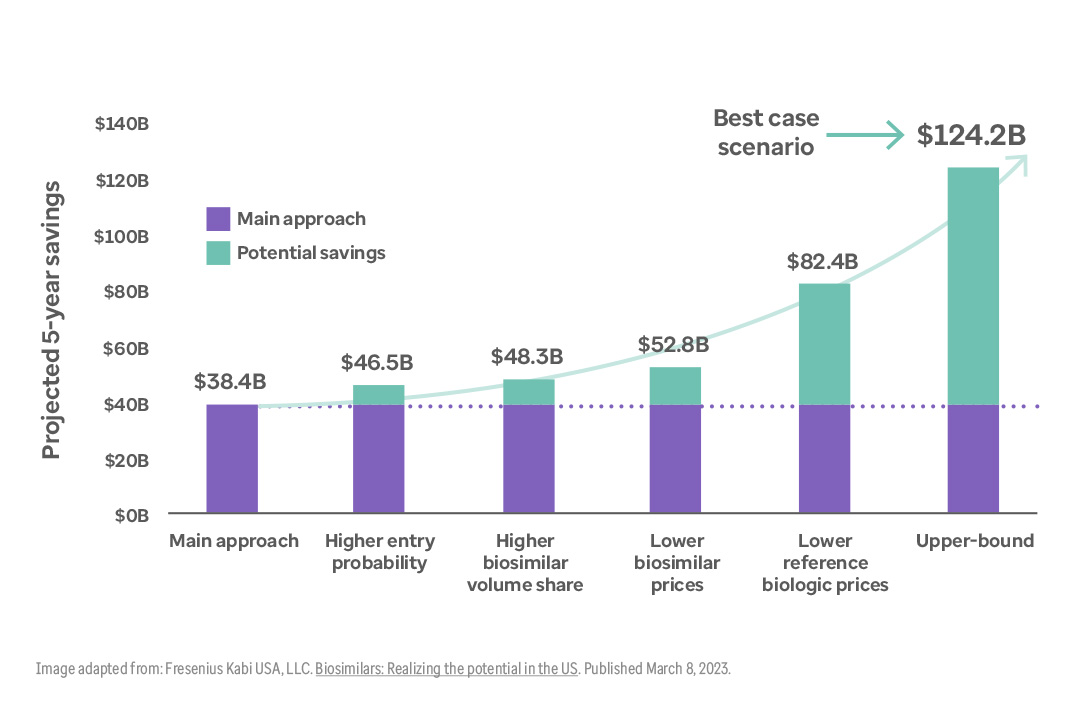

Potential overall savings

It’s no coincidence that right now there are many new biosimilars approved or in late development. Approximately 90 biosimilar products are expected to launch within 1 to 4 years.11

As a result, the RAND corporation estimates that savings from biosimilar drugs could be worth more than $38 billion from 2021 to 2025. They also calculate a most-optimistic scenario that assumes more aggressive biosimilar uptake and competition. That could lead to much larger savings — almost $125 billion over the same timeframe.12

This graph illustrates the different variables that could affect overall savings from biosimilars. Note how the potential savings from lower prices for original reference products (second bar from the right) far outweigh the lower prices for biosimilars (third bar from the right).

Biosimilars savings projections

Key variables could increase total savings over time

Biosimilar savings could reach $124 billion with several realistic assumptions.

This graph illustrates different variables that could affect overall savings from biosimilars from 2021 through 2025. Potential savings are $38.4 billion in the base scenario. Additional savings are projected assuming higher entry probability ($46.5 billion), higher biosimilar volume share ($48.3 billion), lower biosimilar prices ($52.8 billion) and lower reference drug prices ($82.4 billion). The upper bound (best case) saving projection assumes all of these variables are in play, resulting in $124.2 billion in savings over the time period.

Uptake and interchangeability

Now that biosimilars are reaching the market in larger numbers, one concern is uptake. Will payors, doctors, and patients resist switching?

Biosimilar adoption in the U.S. has lagged compared to Europe. For example, in 2018, biosimilar versions of Neulasta® (pegfilgrastim) were launched in both the U.S. and Europe. By 2021, biosimilars had gained 90% of the market in Spain and 85% in Italy and the United Kingdom. But in the U.S., pegfilgrastim biosimilars captured only 40% of the market.13

After a relatively slow start, Optum Rx is encouraged by the uptake we’ve seen under the medical benefit. This is because physicians prescribe and administer the drugs in a clinical setting. As more biosimilars become available through the pharmacy benefit, uptake begins to depend more on patient acceptance. This step may require additional education.

Here are some basic reasons why biosimilars are lagging, along with reasons to expect their use to grow:

- Some doctors are not yet comfortable with replacing the branded products they have been using successfully with something new.14

- Our contracting/payment system features complex contracting and reimbursement arrangements.15

- A relatively new issue is interchangeability.16

Let’s see how these barriers are beginning to break down.

Physician reluctance to switching

While it is true that physicians may initially be reluctant to switch to a biosimilar, this may only last a short time. As noted above, under the medical benefit, the health care professional directly administers the treatment to the patient. This means there is no patient “brand loyalty.”

Under the pharmacy benefit, switching from the branded version will require educating each patient about just what a biosimilar is, and why they are safe and effective. This is an extra step on the path to biosimilar adoption in the pharmacy benefit.

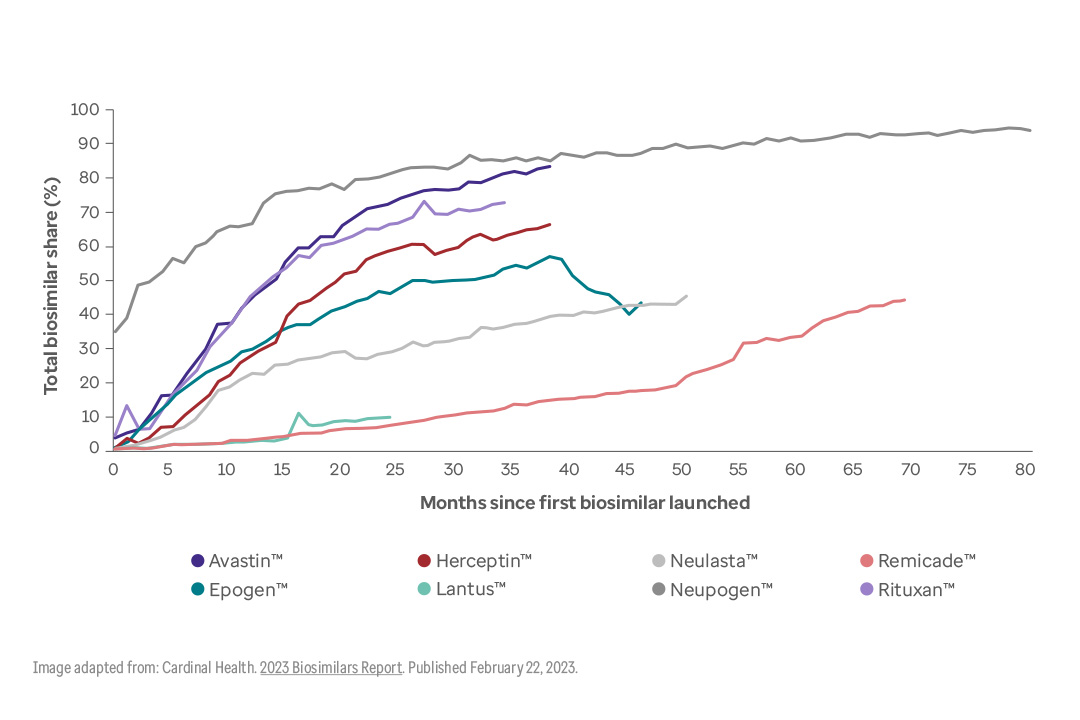

This graph shows that, despite any initial reluctance, biosimilar adoption trends sharply upward within one year after launch.

Biosimilars see steady increase in uptake

Biosimilars seem readily accepted by prescribers

This graph shows the increase in uptake over time for 8 biologic drugs: Avastin, Epogen, Herceptin, Lantus, Neulasta, Neupogen, Remicade, and Rituxan. Most drugs seem to accelerate at around months 5-15. By month 40 after introduction, all drugs except Remicade and Lantus had achieved at least 40% of market share in their class. Remicade reached 40% at month 70, while Lantus is just 24 months on market.

Prescribers differ among specialties

We should note that prescriber attitudes differ among clinical areas. Some specialties have seen quite a bit of biosimilar activity — for example, rheumatology and gastroenterology. But other areas, like dermatology and ophthalmology, are less experienced with these products.17

In a recent survey, 86% of gastroenterologists and 62% of rheumatologists said they are “very comfortable” prescribing biosimilars to their patients.18

But the same survey found that only 35% of dermatologists fell in to the "very comfortable" category. Interestingly, 56% of ophthalmologists said they would be willing to prescribe a biosimilar — but only if it had achieved the FDA interchangeability designation (see below).19

Payment complexity

It is well known that the U.S. has one of the most complex health care systems in the world.20 And the clinical, financial and legal issues surrounding biosimilar drugs are correspondingly complex.

Consequently, the system is going to need to adopt new, streamlined processes in order to start realizing the benefits of biosimilars. These steps will include everything from patient and physician education to nitty gritty details like stocking and storing supplies of often temperature-sensitive medications.21 It’s going to take some time.

Biosimilar and biologic interchangeability

The basic concept of interchangeability should be familiar. Think of how almost any generic drug can be substituted at the pharmacy for a brand-name drug, without having to check with the doctor first (subject to state law).22

For biosimilars things are different, at least in the U.S. Broadly speaking, both U.S. and EU regulators must certify that biosimilars are as safe and effective as their reference products. Notably, EU regulators consider all their approved biosimilars to be interchangeable with their reference products without additional studies.23

The fact that no additional designation of interchangeability is required in the EU could be one reason for their highly successful biosimilar adoption rates.

But in the U.S., FDA rules have established a different category for biosimilars that have also been designated as interchangeable. An interchangeable biosimilar must meet additional requirements in order to be substituted for the reference product in the retail pharmacy setting.24

Switching among biosimilars

To be designated interchangeable, a biosimilar must undergo a "switching study." This is essentially an additional phase 3 trial, with all of the cost and time that entails. The goal is to make sure that clinical outcomes are the same even if patients are repeatedly switched between the reference product and the biosimilar.25

Some biosimilar manufacturers argue that establishing this new designation category could create needless doubts about non-designated biosimilars. In other words, Congress and the FDA may have unintentionally created the impression that designated interchangeables are somehow “better biosimilars.”26

Whether this will actually impede biosimilar acceptance into mainstream health care remains to be seen.27

One large distributor notes that, as biosimilars are moving into the pharmacy benefit, biosimilar makers will come to see interchangeability as a competitive advantage. That would make satisfying the extra regulatory requirements worthwhile.28

We can see this playing out with the Humira biosimilars that are currently approved, or pending approval. Of these, only one has the interchangeable designation (Cyltezo® — adalimumab-adbm). However, at least 5 other biosimilar competitors are currently seeking interchangeable status.29

This leads to an interesting question. If some Humira competitors are interchangeable, and some are not, will we see a difference in their uptake? This is worth watching.

Ensuring efficacy, safety and affordability

Bringing biosimilars to the marketplace is one of the biggest opportunities in years to lower costs and increase accessibility for consumers. More broadly, this is an important moment for the health care system. As more biosimilars come to market, Optum Rx will continue to collaborate across the health care industry. Our goal is to ensure that these products are thoroughly evaluated, so that we can make informed decisions about whether they will be added to our formulary.

Critically, competition is vital to foster innovation and drive down the cost of prescription drugs. We encourage our colleagues across the health care sector to join us in supporting efforts to increase competition across the market.

This approach, as with all our formulary decisions across drug classes, is driven by our commitment to ensuring the clinical efficacy, safety and affordability of the drugs. Ultimately, this will offer greater affordability and choice for members with no disruption to treatment, while generating greater value within the health care system.

Related content

Unlocking the promise of personal medicine

3 new first-in-class therapies coming

4 key forces shaping the future of pharmacy

References:

- AJMC. The Center for Biosimilars. US Welcomes First Adalimumab Biosimilar, Amjevita. Published January 31, 2023. Accessed February 7, 2023.

- ibid.

- MedChemComm. What are the drugs of the future? Published May 1,2018. Accessed February 3, 2023.

- U.S. Food and Drug Administration. Biosimilars: Review and Approval. Content current as of December 13, 2022. Accessed February 2, 2023.

- Fresenius Kabi USA, LLC. Biosimilars: Realizing the potential in the US. Published March 8, 2023. Accessed February 9, 2023.

- Association for Accessible Medicines (AAM).The U.S. Generic & Biosimilar Medicines Savings Report. Published September 2022.] Accessed March 9, 2023.

- AJMC. The Center for Biosimilars. US Welcomes First Adalimumab Biosimilar, Amjevita. Published January 31, 2023. Accessed February 7, 2023.

- Evaluate Vantage. AbbVie puts (some) numbers on expected Humira erosion. Published February 9, 2023. Accessed February 13, 2023.

- Mercer Health News. Humira Biosimilars Could Reshape the Market. Published January 31, 2023. Accessed February 11, 2023.

- McKinsey & Company. Three imperatives for R&D in biosimilars. Published August 19, 2022. Accessed January 26, 2023.

- AmerisourceBergen. U.S. Biosimilar Report. Published February 6, 2023. Accessed February 10, 2023.

- American Journal of Managed Care. Projected US Savings From Biosimilars, 2021-2025. Published January 3, 2022. Accessed March 9, 2023.

- Mercer Health News. Humira Biosimilars Could Reshape the Market. Published January 31, 2023. Accessed February 11, 2023.

- Fresenius Kabi USA, LLC. Biosimilars: Realizing the potential in the US. Published March 8, 2023. Accessed March 9, 2023.

- Ibid.

- Duke Margolis Center for Health Policy. Revisiting Interchangeability to Realize the Benefit of Biosimilars. Published October 15, 2021. Accessed March 7, 2023.

- Cardinal Health. 2023 Biosimilars Report. Published February 22, 2023. Accessed March 7, 2023.

- Ibid.

- Ibid.

- International Society for Pharmacoeconomics and Outcomes Research, Inc. US Healthcare System Overview-Background. Accessed March 9, 2023.

- Fresenius Kabi USA, LLC. Biosimilars: Realizing the potential in the US. Published March 8, 2023. Accessed March 9, 2023.

- Duke Margolis Center for Health Policy. Revisiting Interchangeability to Realize the Benefit of Biosimilars. Published October 15, 2021. Accessed March 7, 2023.

- Managed Healthcare Executive. Are Interchangeable Biosimilars Better? Published September 9, 2022. Accessed March 7, 2023.

- Duke Margolis Center for Health Policy. Revisiting Interchangeability to Realize the Benefit of Biosimilars. Published October 15, 2021. Accessed March 7, 2023.

- Drug topics. What Biosimilar Interchangeability Status Would Mean for Pharmacists. Published November 16, 2021. Accessed February 7, 2023.

- Managed Healthcare Executive. Are Interchangeable Biosimilars Better? Published September 9, 2022. Accessed March 7, 2023.

- Ibid.

- Cardinal Health. 2023 Biosimilars Report. Published February 22, 2023. Accessed March 7, 2023.

- AJMC. Eye on Pharma: Celltrion Aims for Adalimumab Interchangeability; Phase 3 Results for Ustekinumab Biosimilar. Published August 16, 2022. Accessed March 9, 2023.

Image 1. "Biosimilars price impact" - Adapted from: Fresenius Kabi USA, LLC. Biosimilars: Realizing the potential in the US. Published March 8, 2023.

Image 2. "Big turnaround in Humira class of drugs" - Adapted from: Association for Accessible Medicines. 2022 U.S. Generic and Biosimilar Medicines Savings Report. Published September 2022.

Image 3. "55 high-cost biologic drugs face competition" - Adapted from: McKinsey & Company. Three imperatives for R&D in biosimilars. Published August 19, 2022.

Image 4. "Biosimilars savings projections" - Adapted from: Fresenius Kabi USA, LLC. Biosimilars: Realizing the potential in the US. Published March 8, 2023.

Image 5. "Biosimilars see steady increase in uptake" - Adapted from: Cardinal Health. 2023 Biosimilars Report. Published February 22, 2023.