Flexible options

Choose from specific or aggregate products and tailor details to your organization’s needs, including coverage terms, premium levels and risk tolerance.

Additional health programs

We offer a variety of programs to help people get healthy and help people stay healthy, including complex care management, managed transplant carve-out and health savings accounts.

With more than 34 years in the insurance industry, including 25+ years in stop loss, I’ve built a strong, expansive network of brokers and TPAs throughout the Mid-Atlantic and Northeast. I truly enjoy partnering with my clients and working together to find solutions.

When I’m not in the office, you’ll likely find me either working in my gardens or trying a new recipe. Sous vide, anyone? Email me to schedule a brief meeting to discuss the advantages of Optum® Stop Loss and other Optum product offerings.

CT, DE, ME, MD, MA, NH, NJ, NY, PA, RI, VT, VA, WV

With 18 years of experience within health care benefits with a proven record of sales and marketing, I value partnerships built on trust and transparency. My background in the broker world allows me to find creative solutions for producers that meet their clients’ needs.

I live in Minnesota with my husband and two boys. When I am not working, I can be found traveling or taking my children to various sporting events. Email me to schedule a brief meeting to discuss the advantages of Optum Stop Loss and other Optum product offerings.

AK, HI, WA, OR, CA, NV, AZ, MI, IN, OH, KY

With more than 20 years of experience managing and selling self-funded business, I use a proven, strategic approach to help drive growth for my broker partners. I bring an analytical approach to my work, having earned a Bachelor of Science in engineering from the United States Military Academy.

My home is in beautiful Charlotte, NC, where my wife and I are enjoying raising our young son and daughter. Email me to schedule a brief meeting to discuss the advantages of Optum Stop Loss and other Optum product offerings.

TX, AR, LA, MS, TN, AL, GA, NC, SC, FL

Clients value my 20+ years of insurance and benefits experience and the priority I place on attentive customer service. My focus is the marketing and sales of the Optum Stop Loss offering in my region.

I currently reside in beautiful Victoria, MN, and enjoy golfing and traveling — especially to wine country in California and anywhere with a beach. Email me to schedule a brief meeting to discuss the advantages of Optum Stop Loss and other Optum product offerings.

ID, MT, WY, UT, CO, NM, ND, SD, NE, KS, OK, MN, IA, MO, WI, IL

Complementary solutions

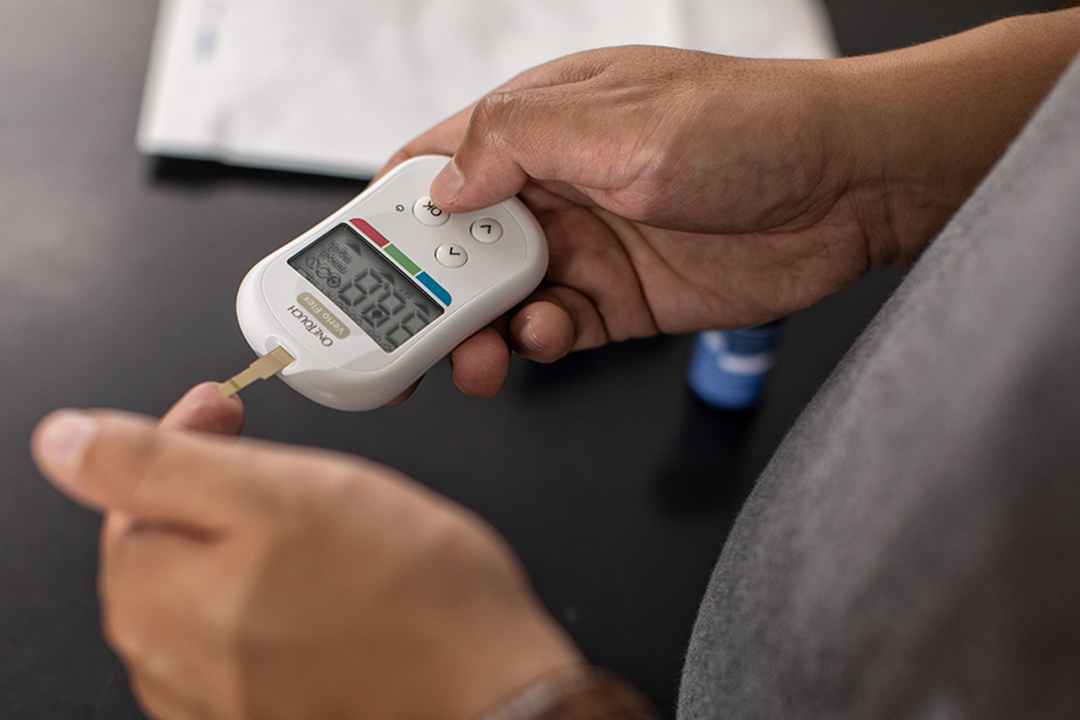

Health Savings Accounts (HSAs)

Accelerate progress toward a healthier future with an HSA that helps employees take control of their care, payments and overall health.

Flexible Spending Accounts (FSAs)

Help your employees budget and save for qualified expenses during the benefit plan year through pre-tax contributions.

Health Reimbursement Arrangements (HRAs)

Use this custom-designed, employer-funded plan to help offset employees’ health care costs, while providing tax savings to the organization.